10 Wealth-Building Rules That Create 80% of Your Results With Just 20% Effort

There’s a strange moment that comes with money, usually after years of effort, when you realize the math never promised fairness. You can work hard, stay responsible, read the right books, and still feel like progress arrives in uneven bursts. Long plateaus. Then sudden shifts. Then stillness again.

That unevenness used to bother me. It felt like failure or inconsistency. With time, it started to look more like a pattern.

Economists have a name for it. The rest of us usually learn it by living through it.

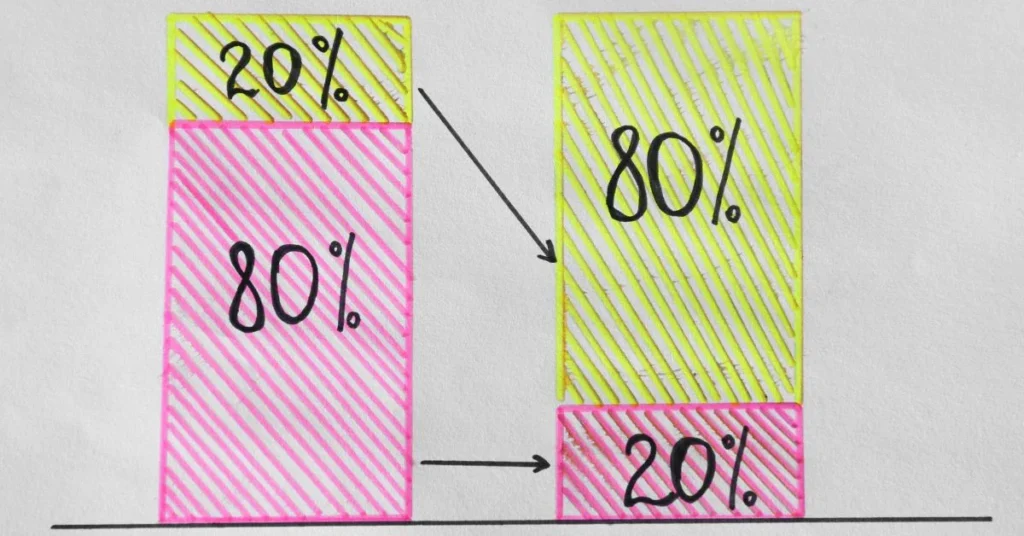

The 80/20 principle, first observed by Vilfredo Pareto over a century ago, showed that about 20 percent of Italy’s population owned 80 percent of the land. Since then, similar distributions have appeared everywhere people bother to measure. Income, productivity, company profits, investment returns. Today, data suggests roughly the top 20 percent of earners hold more than 80 percent of total income in many developed economies.

Wealth, it turns out, doesn’t respond evenly to effort. It never did.

Most outcomes come from a surprisingly small set of behaviors. The rest feels busy. Necessary, maybe. But not decisive.

What follows isn’t a framework to follow. It’s a set of rules that seem to quietly shape results, whether we acknowledge them or not.

1. The Biggest Financial Gains Come From a Few Repeated Decisions

There’s comfort in believing that progress comes from constant adjustment. New strategies. New accounts. New tactics. But most lasting wealth traces back to a small number of decisions made early and repeated without much drama.

Studies of self-made millionaires reinforce this. In a five-year behavioral study of 233 wealthy individuals conducted by Tom Corley, nearly all significant wealth outcomes were tied to just a handful of habits. Saving aggressively. Investing consistently. Avoiding lifestyle excess. The rest varied widely.

This is uncomfortable because it strips away novelty. It suggests that doing the same sensible thing for twenty years matters more than discovering something clever once.

We don’t like that idea. It feels slow. Ordinary. Almost boring.

But boring, repeated decisions have a way of compounding quietly while attention drifts elsewhere.

2. Income Is the Accelerator No One Likes to Talk About

There’s a moral comfort in focusing on budgeting and discipline. It suggests virtue alone can carry you forward. But the numbers tell a more complicated story.

In Corley’s research, 95 percent of wealthy individuals saved at least 20 percent of their income. That level of saving is difficult, sometimes impossible, without sufficient earnings. Discipline matters, but capacity sets the ceiling.

Income doesn’t guarantee wealth. Plenty of high earners struggle. But low income severely limits options. It turns every mistake into a crisis and every opportunity into a gamble.

This is why wealth conversations eventually circle back to skills, leverage, and value creation. Not because they’re glamorous, but because they expand the range of possible outcomes.

3. Time Does More Heavy Lifting Than Intelligence

One of the quieter findings across wealth research is how unexceptional most outcomes look year to year.

Thomas Stanley’s work, later published in The Millionaire Next Door, showed that most American millionaires didn’t build wealth through sudden windfalls or extraordinary brilliance. They accumulated steadily over 12 to 32 years. Ordinary returns. Long timelines.

Time smooths mistakes. It forgives early missteps. It magnifies consistency. Without time, even good decisions struggle to matter.

This is why waiting, dull as it sounds, is one of the most powerful financial skills.

4. Saving Is Less About Frugality Than Direction

Living below your means gets framed as denial. In reality, it’s allocation.

In Stanley’s research, the majority of millionaires lived in modest neighborhoods, spent conservatively on housing, and avoided status spending. Housing costs typically stayed under 25 percent of income. Not because they lacked money, but because they understood what spending actually does.

Every dollar spent is a dollar that stops compounding.

That doesn’t mean deprivation. It means clarity. When spending aligns with values, saving stops feeling like a sacrifice and starts feeling intentional.

5. A Few Habits Drive Disproportionate Gains

The wealthiest individuals in Corley’s study didn’t do everything right. But they did a few things reliably.

Nearly 88 percent spent at least 30 minutes a day reading for self-education. Not news. Not entertainment. Material that expanded skills or perspective. Over decades, that habit quietly shaped income, judgment, and opportunity.

About 76 percent exercised aerobically at least four days a week. Over 90 percent prioritized adequate sleep. These aren’t wellness trends. They’re capacity investments. Energy, focus, and longevity compound just like money does.

The point isn’t optimization. It’s that a small cluster of habits seems to support most long-term outcomes.

6. Multiple Income Streams Reduce Fragility More Than They Increase Wealth

Roughly 65 percent of self-made millionaires had three or more income streams before reaching seven figures. Not because they chased complexity, but because dependence is risky.

Multiple streams don’t always accelerate wealth dramatically. What they do is reduce vulnerability. They give room to think, adjust, and endure downturns without panic.

Financial fragility forces bad decisions. Stability creates patience.

7. Complexity Often Masks Avoidance

Sophisticated strategies can be useful. They can also be a distraction.

Many people spend years fine-tuning portfolios while neglecting career leverage, or spending on alignment. The basics feel too obvious to revisit. Too exposed.

But research consistently shows that a few fundamentals account for most results. Save consistently. Invest broadly. Avoid unnecessary debt. Let time work.

When things feel confusing, it’s often because something simple is being sidestepped.

8. Social Comparison Distorts Otherwise Sound Plans

Comparison doesn’t usually make people reckless. It makes them anxious.

Stanley observed that under-accumulators of wealth often lived near higher earners and spent accordingly, while prodigious accumulators ignored social pressure entirely. The difference wasn’t income. It was orientation.

Wealth built to keep pace rarely compounds. Wealth built around personal metrics tends to endure.

9. Automation Turns Discipline Into Background Noise

One of the most practical applications of the 80/20 principle is automation. When 20 percent of income is automatically directed toward savings and investments, the need for constant decision-making disappears.

The wealthy rarely rely on motivation. They remove the choice entirely. Systems replace effort. Results follow quietly.

10. Knowing What “Enough” Means Prevents Endless Drift

Without a sense of enough, accumulation becomes aimless.

Many high earners continue escalating risk and stress, not because they need to, but because they never paused to define what sufficiency looks like. The goal keeps moving, quietly.

Enough isn’t a number that ends ambition. It’s a reference point that anchors it.

A Few Observations That Linger

• Most wealth comes from a small number of repeated behaviors

• Income expands options; time amplifies decisions

• Simplicity often reflects clarity, not ignorance

• Social pressure erodes more wealth than bad math

• Systems outperform motivation over long horizons

Conclusion

Wealth-building, in the end, isn’t about intensity. It’s about alignment sustained over time.

Charlie Munger once remarked that the big money isn’t made in the buying or selling, but in the waiting. It sounds almost dismissive until you realize how much patience actually asks of you.

Waiting requires restraint. Trust. A willingness to look ordinary for a very long time.

And for most people who quietly build real wealth, that’s exactly how it happens.